Petrax Global Oil and Gas pushes ahead with plans to bring in $400 million FDI to acquire refineries and tank farms in the UAE

Petrax also in discussions to hire advisors for its IPO

Last year shares of other oil refining and trading companies came under severe selling pressure when the lock-in period for pre-IPO investors ended. This has caused many investors to eye the expiry of lock- in periods with apprehension and a certain nervousness. Whether they hold on to the shares or sell them also depends on the investor category. For instance, anchor investors, who are allotted shares a day before the IPO opens, have a lock-in of 30 days and 90 days. Though it is not a rule, anchor investors usually try to make quick exits on good gains. The lock-in period for non-promoters is six months and for promoters is 18 months. Slightly over a third of the companies’ shares are being offered for listing. Some of the stocks have made good gains since listing news, Frank Khoie, CEO of the U.S based parent company said. The expiry of lock-in periods did not necessarily mean that the shares would be sold. It all depends on the view taken by investors and what kind of gains the stocks shall make post-listing.

Frank Khoie, CEO

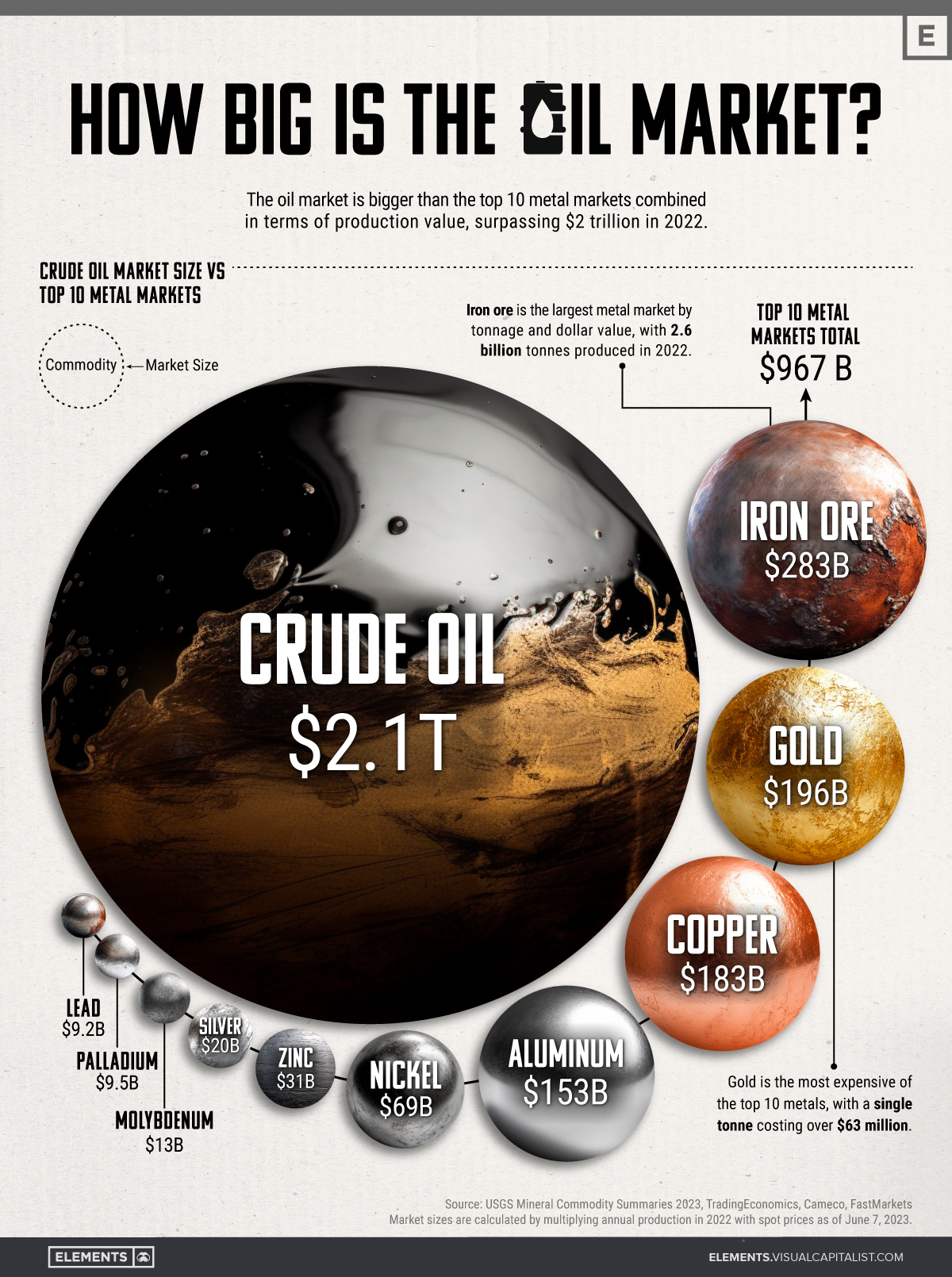

Oil market production value exceeds $2 trillion

The above infographic puts crude oil’s market size into perspective by comparing it to the 10 largest metal markets combined. To calculate market sizes, we used the latest price multiplied by global production in 2022, based on data from TradingEconomics and the United States Geological Survey (USGS). Note: This analysis focuses on raw and physical materials, excluding derivative markets and alloy materials like steel.

In 2022, the world produced an average of 80.75 million barrels of oil per day (including condensates). That puts annual crude oil production at around 29.5 billion barrels, with the market size exceeding $2 trillion at current prices. That figure dwarfs the combined size of the 10 largest metal markets: the combined market size of the top 10 metal markets amounts to $967 billion, less than half that of the oil market. In fact, even if we added all the remaining smaller raw metal markets, the oil market would still be far bigger. This also reflects the massive scale of global oil consumption annually, with the resource having a ubiquitous presence in our daily lives. While the oil market towers over metal markets, it’s important to recognize that this doesn’t downplay the importance of these commodities. Metals form a critical building block of the global economy, playing a key role in infrastructure, energy technologies, and more. Meanwhile, precious metals like gold and silver serve as important stores of value. As the world shifts towards a more sustainable future and away from fossil fuels, it’ll be interesting to see how the markets for oil and other commodities evolve.

Petrax Global Corp, a US based energy trader, in talks with partners in South Korea and Japan to tackle Africa markets by making LPG deals more attractive

This means that the poorest and disadvantaged communities remain on the periphery of social, health and economic opportunities. Without electricity, this segment of the population, dwelling mostly in townships, informal settlements and rural areas relies on biomass and paraffin for household cooking and heating, with increased usage during winter months. Biomass is regarded as “any carbon-based material such as animal waste, industrial waste woody material such as planks, plant material or food waste”.

Apart from the inherent dangers of burning biomass indoors such as possible shack fires, there are serious public health implications. According to the World Health Organization (WHO), as many as 3.8 million people die prematurely every year from illness attributable to the household air pollution caused by inefficient use of solid fuels and kerosene for cooking.

Petrax Global, which recently commenced its operations in Dubai, is intent to make inroads in the country’s energy sector by making liquefied petroleum gas (LPG) accessible to poor communities by partnering with South Korean and Japanese energy trading companies. “The cost of cleaner cooking alternatives such as LPG remains one of the biggest barriers to entry into disadvantaged communities. We believe LPG has a central role to play in ensuring the region's energy dignity and our aim is to service geographically remote and developing communities whilst reducing emissions by allowing consumers to switch away from paraffin and biomass energy generation,” says Vincent Loh, Head of Petrax Global Singapore.

Having lagged significantly in comparison to other countries around the world, South Africa’s LPG market is expected to experience reform and rapid growth in next few years in line with the Gas Master Plan, which aims to increase consumption and local manufacturing to circumvent import costs.

Petrax Global is seeking to secure a wholesale license for the distribution of LPG in South Africa, and acquire a bottling plant, Petrax Global is well positioned to achieve its goal to have 100,000 Gas cylinders in circulation at the end of its 3-year roll-out phase. Petrax Global hopes that the first charge of 15,000 cylinders will be available countrywide by early 2024.

“We see significant growth for LPG in light of the well-documented power supply challenges in South Africa and other countries in Africa. Through LPG Gas, we are committed to investing in cylinders as well as bottling plants to support communities in the adoption of cleaner and safer energy alternatives that are also cost-effective.” adds Vincent Loh.

There are challenges, including township and rural dwellers' apprehension regarding LPG, however, Petrax Global has prepared for this. The company is currently in the final stages of creating a framework for an extensive educational drive to ensure safety and promote sustainable living once the wholesale permit is granted. Also in the pipeline is the launch of the Clean Community Initiative to address broader energy challenges such as lighting and refrigeration, among others.

For partnership opportunities, interested stakeholders are invited to contact ceo@petraxglobal.com for more information.

Petrax Global Inc., an independent energy trading company, issues the following Trading and Operations update in advance of the Company’s annual general meeting (AGM) today at 14.00. The information contained herein has not been audited and may be subject to further review and amendment.

Petrax Global floats PPM to increase equity by $200 million to provide liquidity in volatile energy market

Since entering energy trading business this year, Petrax Global focused on its Dubai unit first and then expanded to Houston as its second branch followed by Singapore and then London. Financial robustness is now very important as high energy prices and extreme price volatility have put an unprecedented pressure on the liquidity of energy trading companies.

”When prices go up, so does the size of margin calls on the energy exchanges. Trading companies like Petrax Global must post collateral to cover potential price fluctuations in the period from when a trade is struck to when the energy is actually delivered. In other words, significant financial strength is needed to ensure continued cross-border trading in Europe, North America, West and East Asia,” says Frank Khoie, Executive Chairman at Petrax Global.

The high energy prices are mainly caused by an energy supply shortage as there has not been enough energy accessible in Europe to match demand since Russia is suffering under sanctions after her attack on Ukraine. When supply does not match demand, and energy prices go up, we need an efficient market to cushion the price volatility. In an efficient market, you need a buyer and a seller, able to post the collateral needed to execute the trades that move energy from areas with surplus production to areas with supply shortages. That is why liquidity is a prerequisite for the cross-border trading that is needed to ensure security of supply and curtail the most extreme price shocks,” Frank Khoie explains.

At a time when European energy markets are experiencing massive pressure on supply, efficient cross-border trading is key to making the most of available energy resources. This is an important part of Petrax Global's decision to raise another $200 million to increase equity and plans for securing greater trading credit facilities with banks.

“We are very excited with the launch of Petrax Global and our hope to play a role in contributing to functioning energy markets. As a new company we focus on building a strong financial base which is very important in the energy trading business and that is why we are pushing with capital increase through PPM to further strengthen our financial position. We realize that in order to position Petrax in a market environment which requires a high degree of liquidity to function as well as to prepare for continued growth, we need to raise more capital in the market”, says Vincent Loh, head of Singapore unit and Board Member in Petrax Global.

The European Union Agency for the Cooperation of Energy Regulators (ACER) states in a report from April 2023 that cross-border trade delivered 34 billion euro of benefit to society in 2022 by ensuring an efficient energy system, preventing blackouts and smoothening price volatility despite the interruptions caused by Russia’s invasion of Ukraine and subsequent economic sanctions on Russia.